Table Of Content

The table above shows a comparison of 30-year vs. 15-year fixed-rate loans for a $250,000 home with a 20% down payment. The monthly payments for the $200,000 mortgage includes homeowners insurance and property taxes for Kansas City, Missouri. Find out how much you can afford with our mortgage affordability calculator.

Year vs 15-Year Mortgage Payments

When determining what home price you can afford, a guideline that’s useful to follow is the 36% rule. Bankrate’s mortgage calculator can help you explore how different purchase prices, interest rates and minimum down payment amounts impact your monthly payments. And don’t forget to think about the potential for mortgage insurance premiums to impact your budget. If you make a down payment of less than 20 percent on a conventional loan, you’ll need to pay for private mortgage insurance, or PMI. For most borrowers, the total monthly payment sent to your mortgage lender includes other costs, such as homeowner's insurance and taxes. If you have an escrow account, you pay a set amount toward these additional expenses as part of your monthly mortgage payment, which also includes your principal and interest.

What is the difference between APR vs interest rate?

They bought a four-bedroom house on two acres in Lebanon, N.H., 24 years ago, and “we made sure to pay off the mortgage before we retired,” said Ms. Apel, 71. Nancy Chockley’s $12 million home sits next to a ski slope in Vail, Colorado. It has a chef’s kitchen with sleek appliances, a family room with a modern fireplace, a balcony with mountain views, and four bedrooms that sleep up to 12 guests. But when Chockley packs up to return home to Washington, DC, she puts family photos back in her assigned cabinets; clothes and skis go into her family’s storage locker.

Desired loan term

Your reserve could cover your mortgage payments - plus insurance and property tax - if you or your partner are laid off from a job. It gives you wiggle room in case of an emergency, which is always helpful. Homeownership comes with unexpected events and costs (roof repair, basement flooding, you name it!), so keeping some cash on hand will help keep you out of trouble. A mortgage loan term is the maximum length of time you have to repay the loan. It is possible to pay down your loan faster than the set term by making additional monthly payments toward your principal loan balance.

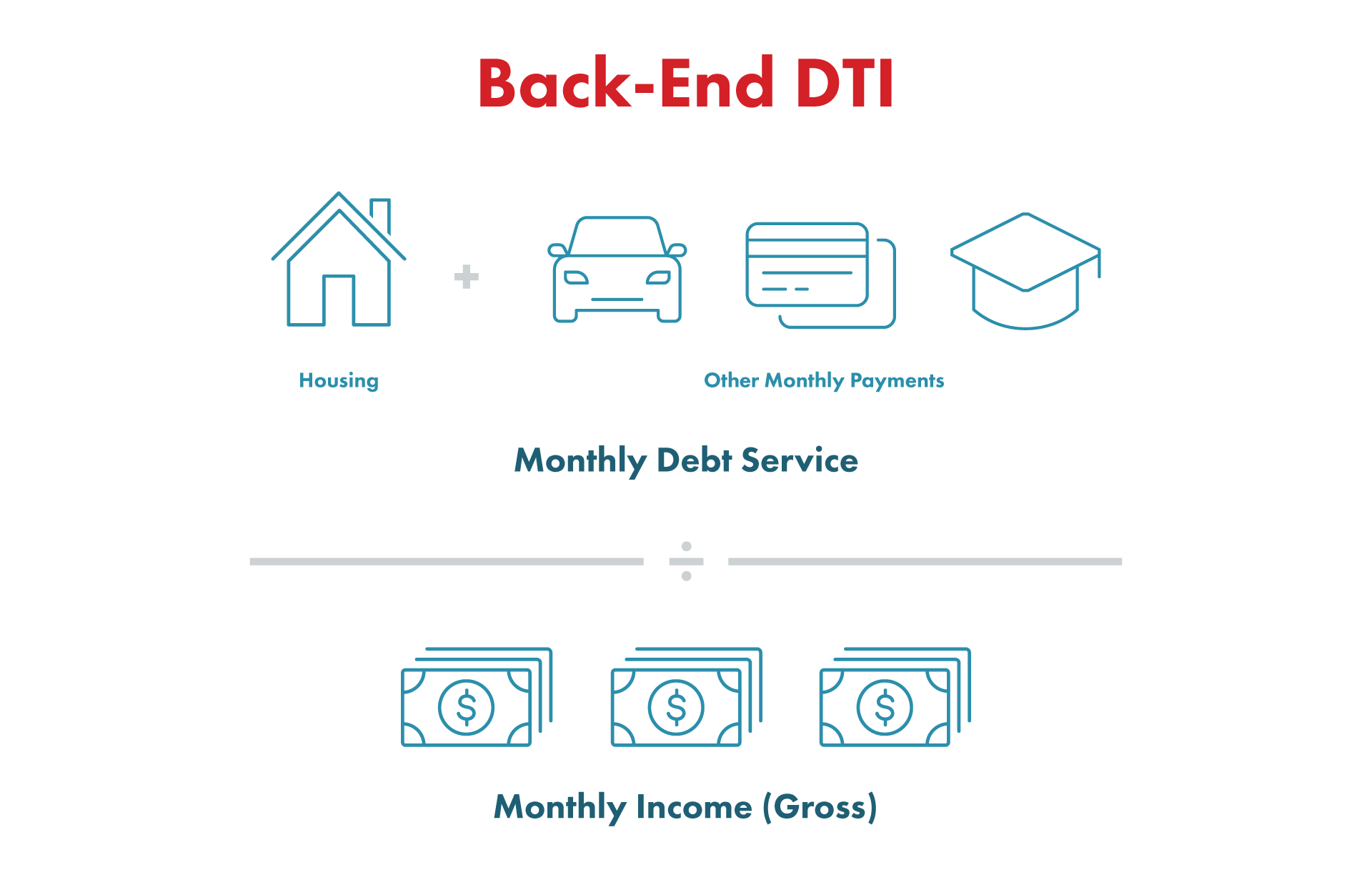

When lenders evaluate your mortgage application, they calculate your debt-to-income ratio (DTI). This is the sum of your monthly debt payments divided by your monthly gross income. Lenders look at this number to see how much additional debt you can take on. Key factors in calculating affordability are 1) your monthly income; 2) cash reserves to cover your down payment and closing costs; 3) your monthly expenses; 4) your credit profile. A good affordability rule of thumb is to have three months of payments, including your housing payment and other monthly debts, in reserve. This will allow you to cover your mortgage payment in case of an unexpected event.

Today's Housing Market Too Expensive for Current Homeowners - Money

Today's Housing Market Too Expensive for Current Homeowners.

Posted: Tue, 23 Apr 2024 21:19:59 GMT [source]

Mr. Irwin, 71, previously an account manager for a local business, is wearying of yard work and snow shoveling, and finding workers to do those chores instead has become difficult. In summary, Los Angeles, CA, is a city with a rich history, diverse geography, and a dynamic economy. It's a place where the entertainment industry meets technology, fashion, and more.

Keep in mind that shortening your loan term may lower the total interest you pay over the life of the loan, but it will likely increase your monthly payments. Lenders take into account the share of your income that goes toward paying debt — or your debt-to-income ratio — when determining whether you can afford a mortgage. Qualified mortgages, which are mortgages designed to improve the chances that borrowers can pay them back, usually require a debt-to-income ratio below a maximum percentage. The exact amount you should spend on a new home depends on your financial situation. Ideally, you’ll want to avoid spending more than a third of your gross monthly income on your mortgage. However, depending on your finances, you may be able to afford a slightly more expensive home.

Documents needed for mortgage application

The calculators are pre-populated with today’s average mortgage rates from our lender network. But you can change that if you know what rate you’re likely to qualify for. Your interest rate will affect both your monthly payment and your total home buying budget.

How to improve your home affordability

This influences which products we write about and where and how the product appears on a page. You’ll have a comfortable cushion to cover things like food, entertainment and vacations. Budget 1% to 4% of your home’s value each year for home maintenance. You might not spend this amount each year, but you’ll spend it eventually.

By refinancing an existing loan, the total finance charges incurred may be higher over the life of the loan. Even then, you should get quotes from multiple lenders before you finally settle on one. Because such comparison shopping is the only way to make sure you get a great deal.

If you want to explore an FHA loan further, use our FHA mortgage calculator for more details. If you have a VA loan, guaranteed by the Department of Veterans Affairs, you won’t have to put anything down or pay for mortgage insurance, but you will have to pay a funding fee. Closing costs, which will run you about 2% to 5% of the purchase price, will affect how much home you can afford to a greater or lesser extent depending on how you pay for them.

Nearly 40% of Homeowners Couldn't Afford Their Home If They Were to Buy It Today - Redfin News

Nearly 40% of Homeowners Couldn't Afford Their Home If They Were to Buy It Today.

Posted: Tue, 23 Apr 2024 12:42:35 GMT [source]

Check out this guide for the different methods for determining how much of your income should go to your mortgage. Most lenders want you to have a credit score of at least 620 to get a conventional loan. However, it is possible to get a mortgage with a bad credit score, but you will have to put more money down or pay a higher interest rate. Check the county assessor’s website and local real estate listings to get an accurate idea of the property tax rates in the area where you’re buying.

No comments:

Post a Comment